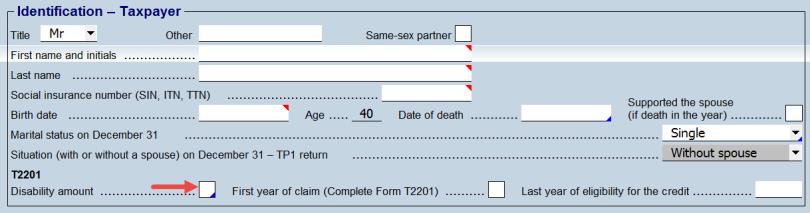

Select the Disability amount box in the Identification form in order for Taxprep to determine the disability tax credit. A check box is provided both in the “Identification – Taxpayer” and the “Identification – Spouse” sections to indicate eligibility of the taxpayer and/or the spouse.

A part of Section A in Form T2201 is automatically completed from data entered in the Identification form.

Part B in Form T2201 must be completed and signed by the medical practitioner.

The totality or a portion of the disability tax credit can be transferred to the spouse or the provider of the disabled person.

When the taxpayer’s and the spouse’s return are prepared together, Taxprep transfers the taxpayer’s or the spouse’s unused amount, whichever the case may be.

The following instructions are an exact copy of the last information page that accompanies Form T2201 issued by the CRA:

What is the DTC?

The disability tax credit (DTC) is a non-refundable tax credit that helps persons with disabilities or their supporting persons reduce the amount of income tax they may have to pay. The disability amount may be claimed once the person with a disability is eligible for the DTC. This amount includes a supplement for persons under 18 years of age at the end of the year. Being eligible for this credit may open the door to other programs.

For more information, go to canada.ca/disability-tax-credit or see Guide RC4064, Disability-Related Information.

Are you eligible?

You are eligible for the DTC only if we approve your application. On this form, a medical practitioner has to indicate and certify that you have a severe and prolonged impairment and must describe its effects.

To find out if you may be eligible for the DTC, fill out the self-assessment questionnaire in Guide RC4064, Disability-Related Information. If we have already told you that you are eligible, do not send another form unless the previous period of approval has ended or if we tell you that we need one. You should tell us if your medical condition improves.

If you receive Canada Pension Plan or Quebec Pension Plan disability benefits, workers' compensation benefits, or other types of disability or insurance benefits, it does not necessarily mean you are eligible for the DTC. These programs have other purposes and different criteria, such as an individual's inability to work.

You can send the form at any time during the year. By sending your form before you file your income tax and benefit return, you may prevent a delay in your assessment. We will review your form before we assess your return. Keep a copy for your records.

Fees – You are responsible for any fees that the medical practitioner charges to fill out this form or to give us more information. However, you may be able to claim these fees as medical expenses on line 33099 or line 33199 of your income tax and benefit return.

What happens after you send Form T2201?

After we receive Form T2201, we will review your application. We will then send you a notice of determination to inform you of our decision. Our decision is based on the information given by the medical practitioner. If your application is denied, we will explain why on the notice of determination. For more information, see Guide RC4064, Disability-Related Information, or go to canada.ca/disability-tax-credit.

Where do you send this form?

Send your form to the Disability Tax Credit Unit of your tax centre. Use the chart below to get the address.

| If your tax services office is located in: | Send your correspondence to the following address: |

| Alberta, British Columbia,

Hamilton, Kitchener/Waterloo, London, Manitoba, Northwest Territories, Regina, Saskatoon, Thunder Bay, Windsor, or Yukon |

Winnipeg Tax Centre Post Office Box 14000 Station Main Winnipeg MB R3C 3M2 |

| Barrie, Belleville, Kingston,

Montréal, New Brunswick, Newfoundland and Labrador, Nova Scotia, Nunavut, Ottawa, Outaouais, Peterborough, St. Catharines, Prince Edward Island, Sherbrooke, Sudbury, or Toronto |

Sudbury Tax Centre

Post Office Box 20000, Station A Sudbury ON P3A 5C1 |

| Chicoutimi, Laval,

Montérégie-Rive-Sud, Québec, Rimouski, Rouyn-Noranda, or Trois-Rivières |

Shawinigan-Sud Tax Centre 4695 Shawinigan-Sud Blvd Shawinigan QC G9P 5H9 |

| Deemed residents, non-residents,

and new or returning residents of Canada |

Sudbury Tax Centre

Post Office Box 20000, Station A Sudbury ON P3A 5C1 CANADA or Winnipeg Tax Centre Post Office Box 14000 Station Main Winnipeg MB R3C 3M2 CANADA |

What if you need help?

If you need more information after reading this form, go to canada.ca/disability-tax-credit or call 1-800-959-8281.

Forms and publications

To get our forms and publications, go to canada.ca/cra-forms or call 1-800-959-8281.

See Also