General information

To claim the tax credit, you must have been resident in Québec on December 31, 2019. If you are claiming the credit for a person who died in 2019, he or she must have been resident in Québec on the date of his or her death.

You can claim the credit for eligible expenses that you paid in 2019 for an in vitro fertilization treatment that enables you or your spouse to have a child. Neither you nor your spouse can have had a child before the start of the in vitro fertilization treatment for which the expenses are paid, and a physician must certify1 that neither you nor your spouse has undergone surgical sterilization by vasectomy or tubal ligation, as applicable, other than for strictly medical reasons.

The expenses must also be attributable to a maximum of three in vitro fertilization cycles: a single in vitro fertilization cycle, in the case of a woman 36 years of age or under, and no more than two in vitro fertilization cycles, in the case of a woman 37 years of age or over.

To be eligible, the expenses must be related to an in vitro fertilization treatment that meets the following conditions:

- The cost of the treatment is not covered by a health insurance plan and cannot be reimbursed to the person undergoing the treatment.

- The treatment involves the transfer of a single embryo or, in accordance with a decision made by a physician, a maximum of two embryos, in the case of a woman 37 years of age or over.

- The treatment is carried out in Québec at a centre for assisted procreation that holds a licence issued in accordance with the Regulation respecting clinical activities related to assisted procreation.2

Specifically, the following are eligible expenses:

- expenses paid for an in vitro fertilization activity carried out by a physician;

- expenses paid for an assessment carried out by a member of the Ordre des psychologues du Québec or the Ordre des travailleurs sociaux et des thérapeutes conjugaux et familiaux du Québec;

- expenses paid for drugs that are prescribed by a physician and whose purchase is registered by a pharmacist, and that are not covered by a health insurance plan;

- expenses paid to a business for the transportation of a person undergoing an in vitro fertilization treatment (and, if the person cannot travel without assistance, of the person who accompanies him or her) from the locality where the person lives to a centre for assisted procreation located at least 40 kilometres away, if treatment is not offered in the person’s locality;

- travel expenses incurred for a person (and, if the person cannot travel without assistance, of the person who accompanies him or her) so that the person can undergo an in vitro fertilization treatment at a centre for assisted procreation located at least 80 kilometres away from the locality where the person lives, if treatment is not offered in the person’s locality;

- travel and lodging expenses incurred for a person (and, if the person cannot travel without assistance, of the person who accompanies him or her) so that the person can undergo an in vitro fertilization treatment at a centre for assisted procreation located in Québec, if, as certified by a physician,3 there are no centres for assisted procreation in Québec in a radius of at least 200 kilometres from the locality where the person lives.

The maximum amount of eligible expenses paid by you or, if applicable, your spouse is $20,000 per year. If both you and your spouse paid eligible expenses, the total of the expenses paid by both of you cannot exceed that maximum.

In addition, you cannot include expenses for which you or your spouse were reimbursed (or could be reimbursed), unless the amount of the reimbursement was included in your or your spouse’s income and cannot be deducted elsewhere in either of your income tax returns.

Duly complete this form and enclose it with your income tax return. Do not include any supporting documents, but keep them in case we ask for them.

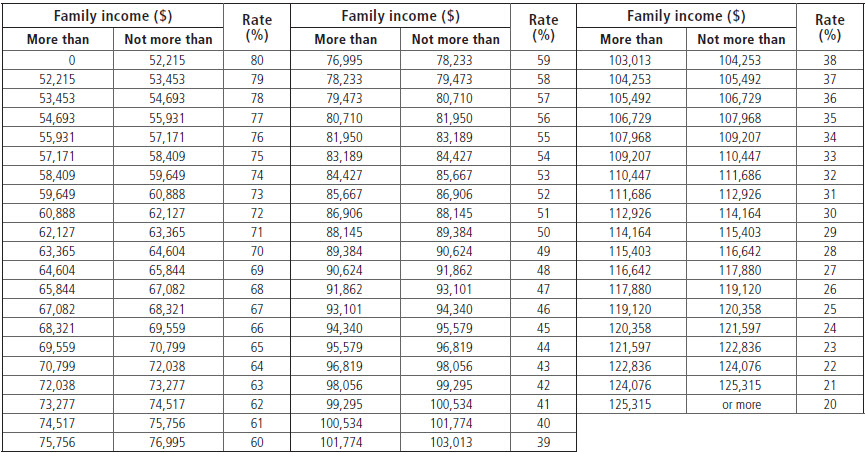

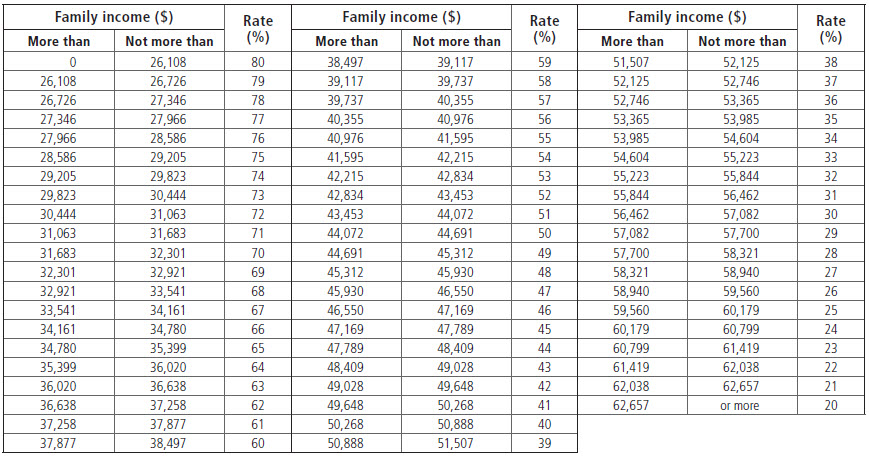

In the table below that corresponds to your family situation, find the tax credit rate for your family income (line 3 of section 2.1) and enter it on line 15 of section 2.2.

Rate of the tax credit if you have a spouse

Rate of the tax credit if you do not have a spouse

__________________

1. You must have a physician complete the appropriate section of form TP-1029.8.66.2M-V, Certificate Respecting the Treatment of Infertility, which you can get on our website, www.revenuquebec.ca.

2. This condition does not apply if the centre is located outside Québec and the person undergoing the treatment lived outside Québec when the expenses were incurred.

3. See note 1.