Release Notes

About Version 1.0

Warnings

Version 2025 1.0

Due to the late arrival of several CRA and Revenu Québec forms, the forms contained in this version have not been approved by the tax authorities. Therefore, do not submit any tax returns that have been prepared with this version to the CRA and Revenu Québec. The electronic transmission of the returns is not available in this version.

Note that, as in previous years, you can still start preparing your tax returns with version 1.0. However, upon printing, the forms will have the Do Not Submit watermark.

Version 2025 2.0

All the electronic services will be available in the next version of Personal Taxprep (2025 2.0), which is scheduled to be released in mid-February.

Version 2025 2.0 will be approved by tax authorities and will allow you to file personal income tax returns.

Modifications Made to Version 1.0

Forms, schedules and workcharts added to the program

Québec

LM-91, Self-declaration Relating to the Application of the Charter of the French Language (Jump Code: QLM-91)

This form is intended for individuals (or individuals in business) who wish to receive services from Revenu Québec in English, in accordance with an exception provided for in the Charter of the French Language. As a general rule, Revenu Québec must communicate with its clients in French only, with some exceptions.

You must complete the form if you are covered by one of the exceptions below:

-

Individuals eligible for English-language education in Québec;

-

Indigenous persons (members of the 11 nations recognized in Québec);

-

Individuals whose primary residence is not in Québec;

-

Immigrants admitted to Canada (except temporary workers) may receive services in English for six months only, after which the services will be automatically provided in French.

You do not have to complete the form if Revenu Québec was already communicating with you in English before May 13, 2021 (acquired right).

Saskatchewan

Saskatchewan Home Renovation Tax Credit (Jump Code: SK S12)

A non-refundable home renovation tax credit has been introduced. Saskatchewan homeowners may save up to $420 annually in provincial income tax by claiming a 10.5% tax credit on up to $4,000 of eligible home renovation expenses. Those who are 65 years old and over at the end of the year may save up to $525 annually, based on maximum eligible home renovation expenses of $5,000.

Modifications Made to Forms

Client letters

The Québec letters have been updated to include the following changes:

-

Form LM-91 has been added as a form to be signed in the client letter.

-

A paragraph confirming that the taxpayer has not received, held or disposed of cryptoassets during the year has been added to the Québec client letters. This paragraph is displayed when box 24 of the TP-1 return is selected to No.

-

Updates have been made to the letters in version 1.0 to take into consideration the new Form TP-1079.8.BE, Foreign Property Return, to be signed, despite the form not being available until version 2.0.

Federal

Direct Deposit Tracking (Jump Code: DD)

The CRA no longer accepts direct deposit enrolments or changes made with EFILE tax software. The sole purpose of this form is now to track the direct deposit information rolled forward from prior years. The name of the form has been modified to reflect this change.

For more information on the direct deposit, visit:

Benefits – Changes to child benefits and abolition of the carbon tax (Jump Codes: CCB, PROV BEN and GSTC)

Several changes have been made to benefits.

CCB and PROV BEN

First, the Canada child benefit (CCB) is now paid for 6 months following the death of a child. As a result of the federal announcement, the provinces below have harmonized their child benefits:

-

Ontario – Ontario child benefit

-

British Columbia – BC family benefit

-

Yukon – Yukon child benefit

-

Nunavut – Nunavut child benefit

-

New Brunswick – New Brunswick child tax benefit

-

Nova Scotia – Nova Scotia child benefit

-

Québec – Family Allowance (the period is 12 months rather than 6 months.)

GSTC

Next, due to the abolition of the carbon tax, the following measures have been removed from the form and client letters:

-

Canada Carbon Rebate

-

British Columbia climate action tax credit

-

Nunavut carbon credit

-

Yukon Government carbon price rebate

-

Northwest Territories cost of living offset

Schedule 3, Capital Gains or Losses (Jump Code: 3)

Periods 1 and 2 have been removed by the CRA.

A section has been added to report the proceeds of disposition and gains (or losses) related to crypto-assets. As a result, these transactions must now be entered in section 6 of Part 3.

Capital gains from certain dispositions of an interest in a partnership subject to a 100% inclusion rate must now be entered in the new field 19890, which is replacing the former field 50410.

Schedule 15, FHSA Contributions, Transfers and Activities (Jump Code: 15)

In order to take into account certain amounts calculated in previous years, several lines have been added to Schedule 15, including two lines relating to the amount of variables F and H of the annual FHSA limit.

T3, Statement of Trust Income (Jump Code: T3)

Deletion of boxes

Since the periods before June 25, 2024, and after June 24, 2024, are no longer necessary in relation to the capital gains inclusion rate but remain relevant in certain situations due to the increase in the lifetime capital gains exemption, numerous changes have been made to the T3 slip.

The following boxes have been deleted:

-

52, 53, 54, 56, 58 and 59

Other boxes have been added:

-

551, 552 and 553 (box 55)

-

571, 572 and 573 (box 57)

T4PS, Statement of Employees Profit Sharing Plan (Jump Code: T4PS)

Deletion of periods 1 and 2 in box 34

The periods before June 25, 2024, and after June 24, 2024, relating to the measure aiming to increase the capital gains inclusion rate announced in 2024, are no longer necessary. As a result, boxes 341a, 341b, 342a, 342b, 343a and 343b have been deleted.

T5, Statement of Investment Income (Jump Code: T5)

Deletion of box 34

The periods before June 25, 2024, and after June 24, 2024, relating to the measure aiming to increase the capital gains inclusion rate announced in 2024, are no longer necessary. As a result, box 34 has been deleted.

T5008, Statement of Securities Transactions (Jump Code: T5008)

Deletion of periods 1 and 2 relating to capital gains

The periods before June 25, 2024, and after June 24, 2024, relating to the measure aiming to increase the capital gains inclusion rate announced in 2024, are no longer necessary. As a result, the lines provided for that purpose have been deleted.

T1028, RRSP/PRPP/FHSA Information or Notice of Assessment (Jump Code: 1028)

In order to calculate Schedule 15 (Jump Code: 15) correctly, substantial information from the previous year is required. This information is included in the notice of assessment for the previous year or in Form T1028 for the current year.

The following lines have been added to enable the roll forward or entry of relevant information:

-

Variable “F” amount of your annual FHSA limit

-

Variable “H” amount of your annual FHSA limit

-

Your FHSA carryforward for 2024

T1141, Information Return in Respect of Contributions to Non-Resident Trusts, Arrangements or Entities (Jump Code: 1141)

Form T1141 has been updated to allow for a joint election to be made so that a single person can file all T1141 returns on behalf of the others when multiple individuals are required to file them.

Boxes have been added to confirm that the information reported in sections A, B, C, and D is supported by supporting documents and to identify the supporting documents that are attached to the form. Questions have been added to page 2 of the form to obtain information about the administration of the trust, the arrangement or the non-resident entity.

T1142, Information Return in Respect of Distributions From and Indebtedness to a Non-Resident Trust (Jump Code: 1142)

Form T1142 has been updated to collect more detailed information on non‑resident trusts and their settlors.

Additional details about the non‑resident trust and its settlors are now requested in section A, and questions regarding the administration of the non‑resident trust have been added to this section.

Boxes have been added to sections A, B and C to confirm that supporting documents related to the information provided are available.

Section D now allows filers to confirm that supporting documents related to sections A, B or C are attached to the form.

Finally, the Japanese yen has been added as a functional currency.

Québec

Schedule H, Tax Credit for Caregivers (Jump Code: QH)

A few changes have been made to Schedule H. These changes are solely related to the layout and have no tax implications.

The grid Reduction Calculation (Lines 259 and 359 of Schedule H) (Jump Code: QH Reduction) for the reduction of the tax credit for a care receiver who turned 18 years old in 2025 has been added to Schedule H.

Revenu Québec has removed Form Tax Credit for Caregivers (Jump Code: Q1029.8.61.64) for a third and/or fourth care receiver. The calculation grid Tax Credit for Caregivers (Additional) (Jump Code: QH ADD) has been created to calculate the credit for a third and/or fourth care receiver.

The grid Reduction Calculation (Lines 259 and 359 of Form TP-1029.8.61.64) (Jump Code: Q1029.8.61.64 RED) for the reduction of the tax credit for a third and/or fourth care receiver who turned 18 years old in 2025 has been replaced by Form Reduction Calculation (Lines 259 and 359 of QH Additional) (Jump Code: QH ADD RED).

Schedule V, Tax Credits for Donations and Gifts (Jump Code: QV)

The tax credit for cultural patronage donations was abolished on March 25, 2025. However, this doesn’t affect the carryforward period for donations made before March 26, 2025.

It remains possible to claim this tax credit for cultural patronage donations made before March 26, 2025 to an eligible cultural organization or a registered museum institution.

Part C of the form has been adjusted to reflect the amendments made to the law. In particular, it specifies that a pledge of donation must have been submitted to the Minister of Culture and Communications no later than March 25, 2025 in order to be eligible.

Request for Direct Deposit (Jump Code: QDD)

Unlike the CRA, Revenu Québec still accepts direct deposit enrolments or changes made with EFILE tax software. As a result, the form has been modified to allow the input without overrides of banking information required for direct deposit with Revenu Québec.

RL-3 Slip, Statement of Investment Income (Jump Code: T5)

Deletion of periods 1 and 2 relating to capital gains

The periods before June 25, 2024, and after June 24, 2024, relating to the measure aiming to increase the capital gains inclusion rate announced in 2024, are no longer necessary. As a result, boxes I-1 and I-2 have been deleted.

RL-16 Slip, Statement of Trust Income (Jump Code: T3)

Deletion of boxes

Since the periods before June 25, 2024, and after June 24, 2024, are no longer necessary in relation to the capital gains inclusion rate but remain relevant in certain situations due to the increase in the lifetime capital gains exemption, numerous changes have been made to the RL-16 slip.

The following boxes have been deleted:

-

A-5, A-6, A-7, A-9, H-4, H-6, H-9, H-10, H-5, H-8 and A-8

Other boxes have been added:

-

H-11, H-22 and H-13 (case H-1)

-

H-21, H-22 and H-23 (case H-2)

-

H-31, H-32 and H-33 (case H-3)

-

H-71, H-72 and H-73 (case H-7)

RL-18 Slip, Statement of Securities Transactions (Jump Code: T5008)

Deletion of periods 1 and 2 relating to capital gains

The periods before June 25, 2024, and after June 24, 2024, relating to the measure aiming to increase the capital gains inclusion rate announced in 2024, are no longer necessary. As a result, the lines provided for that purpose have been deleted.

RL-25 Slip, Statement of Employees Profit Sharing Plan (Jump Code: T4PS)

Deletion of periods 1 and 2 relating to capital gains

The periods before June 25, 2024, and after June 24, 2024, relating to the measure aiming to increase the capital gains inclusion rate announced in 2024, are no longer necessary. As a result, boxes B-2, B-3, C-31, C-41, C-32 and C-42 have been deleted.

TP-752.PC, Tax Credit for Career Extension (Jump Code: Q752.PC)

The form has been updated to reflect the changes announced in the last budget:

-

The age of eligibility has been raised from 60 to 65 years old;

-

The amount of the exclusion of the first dollars of eligible work income has been raised from $5,000 to $7,500;

-

The maximum amount of eligible work income on which the tax credit is calculated has been increased from $11,000 to $12,500.

-

The amount of the reduction threshold has been raised from $40,925 to $56,500;

-

The reduction is now based on net individual income;

-

The applicable reduction rate has been raised from 5% to 7%;

-

The grandfathering rule applicable to workers born before January 1, 1951, has been abolished.

Ontario

ON479, Ontario Credits (Jump Code: ON 479)

Ontario is providing additional support to families who wish to undergo fertility treatment through the new fertility treatment tax credit. This refundable tax credit can cover up to 25% of eligible fertility treatment expenses for Ontario residents, up to a maximum of $5,000 per year. These expenses may include IVF cycles, fertility medications, travel costs for treatment and diagnostic tests.

Alberta

AB428, Alberta Tax and Credits (Jump Code: AB 428)

A tax rate of 8% now applies to the first $60,000 of taxable income. The thresholds for tax brackets exceeding this amount have increased by approximately 2%.

The Alberta supplemental tax credit has been introduced. This credit is equal to 2% of the total amount of certain non-refundable tax credits claimed by an individual that exceeds $60,000. It aims to ensure that Albertans claiming high amounts of non-refundable credits are not disadvantaged by the introduction of the new 8% tax bracket.

Effective July 4, 2025, contributions made to an association of potential candidates qualify for the political contributions tax credit, thus expanding opportunities to support provincial political activities.

General T1, Income Tax and Benefit Return (Jump Code: J)

The section Consent to share contact information – Organ and tissue donor registry has been added to the form.

British Columbia

BC479, British Columbia Credits (Jump Code: BC 479)

The annual limit for the British Columbia venture capital tax credit has increased from $120,000 to $300,000 per individual. This new limit applies only to investments made on or after March 4, 2025.

Effective April 1, 2025, First Nation individuals and persons with disabilities who would have qualified for the Apprenticeship Incentive Grant, had it remained available, are now eligible for a $500 enhanced tax credit for each completed Level 1 or Level 2 of an eligible Red Seal program.

Saskatchewan

Saskatchewan Credits (Jump Code: SK 479)

A refundable fertility tax credit of 50% of eligible expenses, for a maximum credit of up to $10,000, has been introduced.

The maximum amount of the active families benefit for eligible children as well as the income threshold have doubled.

Saskatchewan Graduate Retention Program (Jump Code: RC360)

The maximum lifetime amount of the graduate retention program for individuals graduating on or after October 1, 2024, has increased from $20,000 to $24,000.

Manitoba

MB428, Manitoba Tax (Jump Code: MB 428)

The basic personal amount is now progressively reduced for individuals whose net income exceeds $200,000 and is completely eliminated when the net income reaches $400,000. Moreover, the volunteer firefighters’ amount and the search and rescue volunteers’ amount have been increased to $6,000, bringing the maximum annual credit to $648.

MB479, Manitoba Credits (Jump Code: MB 479)

The former school tax credit for homeowners and the education property tax credit have been replaced with the homeowners affordability tax credit. The renters tax credit has been renamed the renters affordability tax credit. The maximum amount of this credit has been increased to $575 and includes an enhanced supplement of $328 for seniors. A rental housing construction incentive tax credit has also been introduced to support the housing supply in the province.

Finally, the cultural industries printing tax credit, which was initially temporary, has been made permanent. This refundable credit is equal to 35% of eligible printing costs incurred for the production of original Canadian books printed in Manitoba, up to an annual limit of $1.1 million per company.

Nova Scotia

NS428, Nova Scotia Tax (Jump Code: NS 428)

Effective January 1, 2025, the spouse or common-law partner amount, the amount for an eligible dependant and the age amount have increased. The income-based supplement that previously applied to these credits is no longer applicable. The supplement amounts are now included in the base amounts. These credits are now available to all eligible taxpayers, regardless of income. Worksheet NS428 (Jump Code: NS CREDITS) has been adjusted accordingly.

Finally, the tax rate for "other than eligible" dividends has been reduced to 1.5%.

Prince Edward Island

PE428, Prince Edward Island Tax and Credits (Jump Code: PE 428)

As announced in the 2024 provincial budget, tax rates have been lowered for most income brackets, with the exception of the highest bracket, for which the rate has been increased. These adjustments are intended to reduce the tax burden on families and individuals with low or middle incomes in particular.

The tax rates have been revised as follows:

-

Rate reduced from 9.65% to 9.50% on the portion of taxable income of $33,328 or less

-

Rate reduced from 13.63% to 13.47% on the portion of taxable income exceeding $33,328 but not exceeding $64,656

-

Rate reduced from 16.65% to 16.60% on the portion of taxable income exceeding $64,656 but not exceeding $105,000

-

Rate reduced from 18.00% to 17.62% on the portion of taxable income exceeding $105,000 but not exceeding $140,000

-

Rate increased from 18.75% to 19.00% on the portion of taxable income exceeding $140,000

The rate for the Prince Edward Island non-refundable tax credits has decreased and stands at 9.5% for the 2025 taxation year.

Yukon

Schedule YT(S14), Yukon Government Carbon Price Rebate (Jump Code: YT S14)

Starting with the taxation year ending on or after April 1, 2025, Yukon businesses are no longer eligible for the carbon price rebate. This measure has ended due to the termination of the federal carbon pricing program in the territory. The final rebate may be claimed for taxation years ending no later than March 31, 2025.

YT479, Yukon Credits (Jump Code: YT 479)

The refundable Yukon tax credit for fertility and surrogacy expenses is now available for eligible taxpayers. This credit covers 40% of eligible medical expenses, up to a maximum of $10,000 per year, with an unlimited lifetime claim limit.

Nunavut

NU428, Nunavut Tax (Jump Code: NU 428)

Starting in the 2025 taxation year, eligibility for the volunteer firefighters' tax credit has been changed to include search and rescue volunteers, and the credit amount has increased from $500 to $722. Nunavut has also reduced the number of volunteer hours required to claim this credit, from 200 hours to only 50 hours per year.

Forms removed

Federal

-

31350 - Digital News Subscription Expenses

-

AUTHORIZATION - Authorization/cancellation request – signature page

Québec

-

QH Reduction - Calculation (Lines 259 and 359 of Schedule H)

-

TP-1029.8.61.64 - Tax Credit for Caregivers

-

TP-1029.8.61.64 Reduction - Reduction Calculation (Lines 259 and 359 of Form TP-1029.8.61.64)

Corrected Calculations

The following problems have been corrected in version 2025 1.0:

Federal

Convert Preparer Profiles, Client Letters Templates, Print Formats, Filters and Diagnostics

In a new taxation year, remember that the preparer profiles, client letter templates, print formats, filters and diagnostics from the prior period must be converted.

Templates can be converted using the Convert function which is available in each template view. A File/Open dialog box will appear, and the folder opened will be the default location of the prior version template. Select an alternative folder if your prior version template is not in that location. Select all of the templates that you wish to convert.

Once your preparer profiles from last year are converted to the current year, it is important to verify that the options defined with respect to the returns of your clients and to the electronic filing of data (EFILE) still correspond to your situation for the current season.

Electronic services prior years’ support

Federal

In addition to the current tax year 2025, the CRA also supports prior-year electronic services as indicated below until January 2027:

|

2024 |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

|

|

T1 EFILE (original returns) |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

|

|

T1 ReFILE (amended returns) |

✓ |

✓ |

✓ |

|

|

|

|||

|

T1135 |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

|

|

Auto-fill my return (slips only) |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

* You will have to use the Personal Taxprep program for the year in question and update your EFILE password to the current year.

Québec

In addition to the current tax year 2025, Revenu Québec also supports prior-year electronic services as indicated below until January 2027:

|

2024 |

2023 |

2022 |

|

|

TP1 Netfile Québec (original returns) |

✓ |

✓ |

✓ |

|

TP1 Netfile Québec (amended returns) |

✓ |

✓ |

✓ |

|

Tax data download |

✓ |

✓ |

✓ |

* You will have to use the Personal Taxprep program for the year in question and update your EFILE password to the current year.

TaxprepConnect for the 2025 tax season

Important dates

Federal

February 9, 2026 – Opening of the Auto-fill my return service. The CRA tax data can be downloaded using TaxprepConnect.

Québec

February 23, 2026 – Opening of the Tax Data Download service. The Revenu Québec tax data can be downloaded using TaxprepConnect.

Electronic Filing

Federal

Due to its early release date, this version does not allow for electronic filing. The forms related to EFILE are under review in this version.

Information about EFILE

Federal

Important dates

- February 23, 2026 Opening of the EFILE On-Line transmission system.

- January 29, 2027 The CRA will stop accepting electronically filed T1 returns.

Registration and Renewal On-line

To renew your EFILE privileges for this year’s tax season, you must follow the instructions provided on the "Renewal" page on the CRA Web site at https://www.canada.ca/en/revenue-agency/services/e-services/e-services-businesses/efile-electronic-filers/yearly-renewal.html.

To register as a new electronic filer, you must register online by completing the EFILE Registration On-Line form on the CRA Web site at https://www.canada.ca/en/revenue-agency/services/e-services/e-services-businesses/efile-electronic-filers/yearly-renewal.html.

You will find more information concerning renewals and new applications at http://www.efile.cra.gc.ca/.

Québec

Important dates

- February 23, 2026 – Opening of the NetFile Québec system.

- February 23, 2026 – Opening of the Refund Info-line system.

- January 29, 2027 – Shut down of the NetFile Québec system.

NetFile Québec

- Tax preparers must register for “My Account for professional representatives” (available in French only), a secure space on RQ’s Web site, if they have not already done so in the past.

Note that renewal is automatic for persons who registered for this space in the past. - Consult the page “À qui s'adresse Mon dossier” (available in French only) to see which profile applies to you and what actions you can perform online on behalf of a business or an individual.

Roll Forward

Rolling forward 2024 client files

Your 2024 client files must be rolled forward using the Roll Forward command on the File menu, or from the Client Manager, if you want to do a batch roll forward, before you can access them with this version.

Planner Files

You can import client files created in Planner Mode in version 2024.

Slips

The roll forward is performed only for copies of slips in which amounts were entered last year as well as for copies including balances to carry forward, or attached notes or schedules to roll forward.

Attached notes

The attached notes are rolled forward, except if this option is cleared in the roll forward data options.

Rolling Forward ProFile, DT Max and TaxCycle client files (competitor products)

Make sure that the workstation’s regional settings are set to “English (Canada or United-States)” before rolling forward.

Notes – Attached Notes Summary (Jump Code: ATTN)

Schedule – Attached Schedule with Total (Jump Code: ATTS)

When rolling forward client files, the attached notes or schedules attached to fields in the comparative summaries are retained.

Technical Changes

Decommission of the Notice of assessment Download service

The CRA has decided to decommission the Notice of assessment Download service in tax software for all prior and future tax years, effective February 2026. Therefore, this feature has been permanently removed from Personal Taxprep 2025.

In the ID form (Jump Code: ID), the section Notice of assessment or reassessment delivery options for a taxpayer not registered for the CRA’s e-mail notifications has been removed, as it no longer applies.

The CRA has also removed the option to download a notice of assessment in Part E of the T183 form (Jump Code: T183).

Please note that the notices of assessment and reassessment will continue to be available through the My Account or Represent a Client services (for authorized representatives) immediately after the CRA receives and processes a return.

Decommission of the CRA’s authorization service in EFILE software for individuals

On July 15, 2025, the CRA has decommissioned its service used to submit authorization requests for individuals (T1) through EFILE software. Therefore, this feature has been permanently removed from Personal Taxprep 2025. From now on, if you wish to obtain online access for a client, you will need to use the Represent a Client service. Note that we have kept the rolled forward data with regard to prior-year authorizations in the program. This information is now visible at the end of the Other information section in the Identification and Other Client Information form (Jump Code: ID).

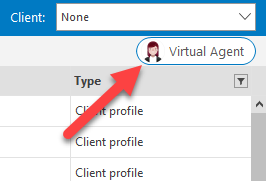

Advanced virtual agent available in Taxprep

You can now chat with our advanced virtual agent from Personal Taxprep. To do so, click the Virtual Agent button located in the top right corner of the program.

The virtual agent provides:

-

Direct descriptive answers to your queries based on our knowledge base articles, allowing you to benefit from an efficient virtual conversation 24 hours a day, 7 days a week.

-

The ability to chat with a live agent during business hours, so you can discuss your support cases with a person in real time.

-

The possibility of submitting a support case after consulting the list of proposed articles according to the nature of your query, which could provide the answers you are looking for before you even need to submit your support case.

Make sure you register for the Support Platform to access your requests and be able to follow up on them. We also invite you to watch this short video for everything you need to know about how the platform works: How to Manage Your Support Cases.

Getting Help

Benefit from our Advanced Virtual Agent 24/7!

Since January 1, 2025, the customer support teams offer their high-quality service exclusively through digital channels, and no longer offer incoming phone support.

Register for our Support Platform and log in to our virtual agent to find answers, submit a support ticket or chat with a live agent.

For more details about the web ticketing system and best practices, watch the following “How to” videos:

Useful support links:

More than 40,000 articles that answer the technical and tax questions most commonly asked to Support Centre agents.

We offer a wide range of useful videos on how the programs work and their most frequently used features.

Select your program and access the Taxprep help topics. You can also access the help topics by pressing the F1 key from within the program.

Support platform to request online support

Submit questions and requests through the virtual agent, support cases or live chat.

The support site brings together news, release documents, the Knowledge Base, the calendar of product release dates, the Download Centre, and more.

Contact the team that can meet your needs

Contact the team that can best meet your needs directly.

Taxprep e-Bulletin

For your convenience, you are automatically subscribed to the Taxprep e-Bulletin, a free e-mail service that ensures you receive up-to-date information about the latest version of Personal Taxprep. If you want to review your subscription to Taxprep e-Bulletin, visit https://support.cch.com/oss/canada and, in the Newsletter section, click Subscription Manager.

You can also register to our Support Platform at https://support.cch.com/oss/canada and submit a support ticket to indicate the products for which you wish to receive general information or information on our CCH software (Personal Taxprep, Corporate Taxprep, Taxprep for Trusts, Taxprep Forms or CCH Accountants’ Suite).

Training

To consult the different training options available regarding Personal Taxprep (seminars, webinars, tutorials and more), access the Training section of the Wolters Kluwer Web site. You can also access it from the program, by selecting Get Taxprep Training in the Help menu.

For Taxprep training, please contact the Professional Services team at learning@wolterskluwer.com.