This form is used for the entry of centralized data into various forms (for example: the company name, address, account numbers, bank information for direct deposit, etc.). It contains most of the information relating to the corporation and generally remains unchanged from year to year.

Internal information for the preparer

One of the things you can do in this section is to activate the profile desired for this particular corporation.

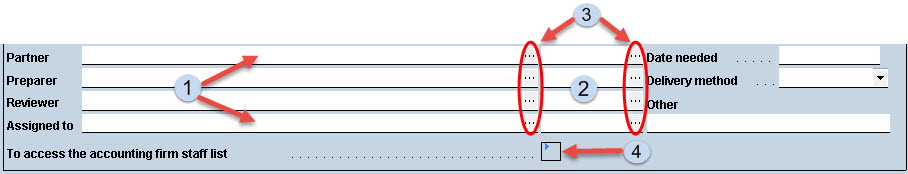

The fields “Tax Preparer’s Profile used,” “Personalized identification number,” “Client code,” “Partner,” “Date needed,” “Preparer,” “Delivery method,” “Reviewer,” “Assigner to,” and “Other” at the top of the form, are only provided to help you manage tax returns. This is not information required on the paper return or information that will be transmitted with EFILE.

Note that the name in the “Partner“ field is kept at all times when rolling forward data. However, the names in the “Preparer,” “Reviewer” and “Assigned to” fields will not be kept if the check boxes Keep the reviewer’s name, Keep the preparer’s name and Keep the field “Assigned to” have been cleared under Roll Forward/Data Options in the Options and Settings dialog box.

If you are using the staff list from the preparer profile, note that the names on that list will be rolled forward once the preparer profile is converted. This preparer profile must first be converted in order for the names to be rolled forward in the client file.

Using preparer profiles to create a list of staff members

You may now create an accounting firm staff list to make it easier to manage the “Partner,” “Preparer,” “Reviewer” and “Assigned to” fields.

|

The names of the staff members selected for the “Partner,” “Preparer,” “Reviewer” and “Assigned to” fields will display in these fields. |

|

The identification numbers of the staff members for the “Partner,” “Preparer,” “Reviewer” and “Assigned to” fields will display in these fields. |

|

Click these buttons to access the list of names or identification numbers of staff members who are assigned the roles of “Partner,” “Preparer” and “Reviewer,” as well as the general list accessible using the “Assigned to” field in the preparer profile used and in the customized list described at point four. You may create separate lists for each of the three roles. As for the list of the “Assigned to” field, it contains the first and last names of all persons in the accounting firm staff list in the preparer profile and in the customizable list described at point four. |

|

Double-clicking this expand box will allow you to access the Accounting Firm Staff List form. The names of the accounting firm staff entered in the list in the preparer profile will be displayed, but cannot be modified. However, if the check box Allow customizing the list using Form Corporate Identification and Other Information has been selected in the preparer profile used, you may add names to the list. Note that the names of staff members added in that section are only accessible in the active client file and are not added to the master list in the preparer profile. |

Note: Using the accounting firm staff list in this section of the form will not be possible if no preparer profile has been converted or created.

“Time” fields relating to the tax year start or end

Note: The CRA considers that a day starts at 00:00 (midnight) and ends at 11:59PM.

“Time” fields relating to the dates entered on line 060, Tax year start, and line 061, Tax year-end

The program will automatically default the value “0000” and “2359” in the “Time” fields related to the dates entered on line 060 and 061 respectively. You can modify the value in these fields only when the corporation is in one of the situations described hereafter. In all other cases, both “Time” fields must not be modified.

The value calculated in the “Time” field related to line 061 can be modified only when the tax year end time is different from 11:59PM and the corporation answers “Yes” to the question on one of the following lines:

- Line 063, Has there been an acquisition of control resulting in the application of subsection 249(4) since the tax year start on line 060?;

- Line 066, Is the date on line 061 a deemed tax year-end according to subsection 249(3.1)?; or

- Line 076, Is this the final tax year before amalgamation?

The value calculated in the “Time” field related to line 060 can be modified only in one the two following situations:

- In the prior tax year, if both:

- the answer on one of lines 063, 066 or 076 was “Yes”; and

- a time different from 11:59PM (“2359”) has been entered in the “Time” field related to line 061; or

- In the current taxation year, if the answer on line 071, Is this the first year of filing after amalgamation? is “Yes.”

If you enter a value other than “0000” for the start or “2359” for the end of the tax year, this value will be transmitted to the CRA (in the electronic transmission or the bar codes). Note that the default values “0000” and “2359” will never be transmitted, as the CRA does not need them.

“Time” field relating to the date of acquisition of control (line 065)

A value can be entered in the “Time” field related to line 065 only when the answer on line 063, Has there been an acquisition of control resulting in the application of subsection 249(4) since the tax year start on line 060?, is “Yes” and the corporation’s tax year end time is different from 11:59PM (“2359”).

In all other cases, this “Time” field must be left blank. If you enter “2359,” this value will not be transmitted to the CRA (in the electronic transmission or the bar codes).

Amended tax return

The term “amended return” is not a term defined in the Income Tax Act. There is only one filing of the return, which is what the CRA refers to as an Initial Assessment (IAS). Any subsequent filing is a Request for Reassessment even though this is often referred to as an “amended return”.

The requirement to electronically file a return only applies to the initial assessment. There is no requirement that a request for reassessment (i.e. amended return) be electronically filed and no penalties will be assessed if it is paper-filed.

Question used to specify whether or not it consists of an adjustment request concerning a federal tax return

Line 997, Is this an amended federal tax return?

If the corporation is filing an amended federal tax return, answer “Yes” to the question on line 997.

When the answer to this question is “Yes,” a detailed description of the changes must be provided on line 996. An expand allows you to directly access the new Form Line 996, Amended Tax Return – Description of Changes.

The amended return includes all forms and schedules as if it were an original return, and not only the amended forms and schedules. All schedules included in the amended return are considered as being amended and the data contained in the schedules will replace all data initially submitted to the CRA in the original return.

Exceptions provided for by the CRA

The CRA is able to process information in the amended returns. However, neither the T2 – Bar Code neither the electronic filing cannot be used to amend the information on the following lines:

- Line 010 (change in head office address)

- Line 020 (change in mailing address)

- Line 030 (change in location of books and records)

- Lines 910, 914 and 918 (direct deposit request)

- Line 990 (language of correspondence)

If a corporation files an amended return, any change of address or language of correspondence, or any direct deposit request will not be taken into account by the CRA. Such changes must be made, prior to filing, by letter, on line or by phone with the Corporate Income Tax Enquiries telephone service.

Electronic filing

When the answer to the question on line 997 is “Yes,” the return’s EFILE status will be changed from “Accepted” to “Eligible,” if the return satisfies the EFILE requirements, or “Not Eligible,” if it does not. When the value of the EFILE status is “Eligible,” you can retransmit the return using the same procedure as for the original transmission.

If you are electronically transmitting a 2nd amended return for the same year end, you must temporarily change the answer to question 997 to No and then back to Yes. This will cause the program to change the Efile status from Accepted to either Eligible or Not Eligible as applicable.

The CRA will only accept an Electronic Request for Reassessment if it is transmitted using the program 2014 v.1 or a later version. If the amended return been prepared using an earlier version (e.g. to amend a 2011 return), you must continue to file a paper copy of the amended return.

Possible Error Messages

The CRA has indicated that an electronically transmitted amended return will only be accepted once the original return has been assessed. Similarly, a second amendment for a given tax year can only be electronically transmitted once the first amended return has been assessed.

If you transmit an amended return prior to filing the original return, or while an assessment is in progress or an Appeal is under review, you would receive an error message as shown below.

|

Description |

Error Code |

Error Message |

|---|---|---|

|

No previous assessment |

521 |

According to CRA’s records, this tax year has not been assessed therefore an amendment cannot be processed. For assistance, contact CRA’s corporation Internet Filing Helpdesk at 1-800-959-2803. |

|

(Re)assessment or Appeal in progress |

522 |

CRA is unable to process this amendment as a (re)assessment is currently in progress or you have an Appeal under review for this tax year. For assistance, contact CRA’s Corporation Internet Filing Helpdesk at 1-800-959-2803. |

Note that you must indicate that a return is an amended return at line 997 in order to transmit it. Otherwise the CRA will assume that it is a duplicate transmission and you will receive the following error message.

|

Description |

Error Code |

Error Message |

|---|---|---|

|

TYE already assessed, possible amended? |

387 |

CRA cannot process the return transmitted for this tax year since they have already received this return. If you are submitting an amended return you must indicate this in your software. For assistance, contact CRA’s Corporation Internet Filing Helpdesk at 1-800-959-2803 |

Question used to specify whether it consists of an adjustment request concerning an Alberta tax return

Is this an amended Alberta tax return?

If the corporation wants to file an amended Alberta tax return, answer “Yes” to this question.

When the answer to this question is “Yes,” and the answer to the question Do you want to electronically file this tax return with Alberta Tax and Revenue Administration? of Form RSI, Electronic Filing and Bar Codes Control Workchart (Jump Code: RSI-EFILE-BAR CODES) is “Yes,” provide a description of the changes on line 073 of Form AT1 EDI Schedule - Alberta Electronic Data Interchange (Jump Code: AEDI). An expand allows you to directly access line 073.

In addition, when the answer to this question is “Yes,” the return EFILE status automatically changes from “Accepted” to “Eligible,” if the return complies with the EFILE requirements, or “Not Eligible,” if it does not. When the value of the EFILE status is “Eligible,” you can retransmit the return using the same procedure as for the original transmission.

If you are electronically transmitting a second amended return for a particular taxation year, you must temporarily change the answer to the question on the line Is this an amended Alberta tax return? to “No,” then set it back to “Yes.” As a result, the program will change the EFILE status from “Accepted” to either “Eligible” or “Not Eligible,” as applicable.

The amended return includes all schedules as if it were an original return, and not only the amended schedules. All schedules included in the amended return are considered as being amended and the data contained in the schedules will replace all data initially submitted to the TRA in the original return.

Question used to specify whether it consists of an adjustment request concerning a Québec tax return

Is this an amended Québec tax return?

If the corporation is filing an adjustment request for a Québec tax return for the current taxation year, answer “Yes” to this question.

However, when the adjustment request covers a prior taxation year, the answer to this question must be “No.”

If you answer “Yes” to the question, the program will answer “Yes” to the question on line 24 of the CO-17 return.

There are two ways of filing a corporation’s amended income tax return that has already been filed with Revenu Québec, i.e.:

- You can complete a separate copy of Form CO-17.R, Request for an Adjustment to a Corporation Income Tax Return or to an Income Tax Return for Non-Profit Corporations (Jump Code: QJR), for each taxation year for which you are requesting an adjustment. To do so you must:

- enclose a copy of Form CO-17, Corporation Income Tax Return (Jump Code: QJ) or Form CO-17.SP, Information and Income Tax Return for Non-Profit Corporations (Jump Code: QJSP), making the desired corrections and specifying that it is an amended return on line 24;

- enclose any documents justifying the adjustment request (related forms, adjusted financial statements, schedules, etc.);

- place your documents in the order specified in Section 3.2 of the Summary of Filing Requirements for Returns – Québec help topic; and

- mail the return and other documents to Revenu Québec.

An expand will allow you to directly access Form CO-17.R, Request for an Adjustment to a Corporation Income Tax Return or to an Income Tax Return for Non-Profit Corporations (Jump Code: QJR). You will be able to complete the form automatically or manually. For more details, consult the following help topic Request for an Adjustment to a Corporation Income Tax Return or to an Income Tax Return for Non-Profit Corporations.

- You can retransmit the CO-17 return electronically.

- The program will transmit a complete amended CO-17 return with the desired changes, and not Form CO-17.R, Request for an Adjustment to a Corporation Income Tax Return or to an Income Tax Return for Non-Profit Corporations (Jump Code: QJR). As with an original return, if you transmit the amended return using the NetFile Québec service, make sure that you have a copy Form CO-1000.TE duly signed by the client allowing you to electronically transmit the amended return.

- The process to prepare an amended CO-17 return is similar to the process already in place for the automatic preparation of an adjustment request. We recommend that you use a copy of the original tax return when you prepare an amended tax return. Answer “Yes” to the question Is this an amended Québec tax return? in Form Identification (Jump Code : ID) and make the amendments in the Québec return.

- When you answer “Yes” to the question Is this an amended Québec tax return? in Form Identification, a copy of Form CO-17.R will be created and the EFILE CO 17 status will no longer be “Accepted,” so that you will then be able to amend the return to make the desired changes.

- Once the transmission is accepted by Revenu Québec, the confirmation number and the date the transmission is accepted will be saved in Forms CO-17.R and EFILE INFO, EFILE Information (Jump Code: TED INFO).

- If you had answered “Yes” to both questions Is this an amended Québec tax return? in Form Identification and Do you want to electronically file this tax return with Revenu Québec? in Form RSI-EFILE Bar codes, RSI, Electronic Filing and Bar Codes Control Workchart (Jump Code: RSI-EFILE-BAR CODES) in the “Québec (Internet Filing) section,” a copy of Form CO-17.R was created. In addition, the program will answer “Yes” to the question Do you want to electronically retransmit the amended CO-17 return instead of mailing a CO-17.R form?, the EFILE CO-17 status will no longer be “Accepted,” and you will then be able to amend the return and make the desired changes.

- If you would still like the amendments made to the return to display in Form CO-17.R.

- If you want to prepare a summary of amendments made in the return, select the check box Select this check box to prepare an automatic CO 17.R form in Form CO-17.R before amending the return. The lines that were modified in the tax return display in Form CO-17.R, as well as the change to the refund or balance due. You can print Form CO-17.R for reference purposes or to provide it to the client. However, the authorized representative does not have to sign the form.

- If you are electronically transmitting a second amended return for a given taxation year, you must temporarily modify the answer to the question on the line Is this an amended Québec tax return? to “No,” then set it back to “Yes.” As a result, the program will change the EFILE status from “Accepted” to either “Eligible,” or “Not Eligible,” as applicable, and a new copy of Form CO-17.R will be created.

Note that neither an amended Form CO-17.SP, Information and Income Tax Return for Non-Profit Corporations nor a CO-17.R adjustment request will be eligible for Internet filing.

Questions in the “General information” section

Here are the calculations performed by the program for each question of the “General information” section.

This question is used to determine if the type of corporation has been the same for the entire taxation year. Certain legislative dispositions require that the type of corporation, for example a Canadian-controlled private corporation (CCPC), be the same for the entire taxation year. When the answer to this question is “Yes,” the program performs the calculations by taking into account that the type of corporation has not been the same for the entire taxation year.

This question is used solely to provide information to the CRA. The program does not perform any calculation based on the answer provided. The answer to this question is retained during roll forward.

Once the corporation elects under subsection 89(11) not to be a CCPC and indicates that it is a CCPC on line 040 of Form Corporate Identification and Other Information (Jump Code: ID), the program activates the calculations in Schedule 54 (Jump Code: 54) for the low rate income pool instead of the calculations in Schedule 53 (Jump Code: 53) for the general rate income pool. Furthermore, the program indicates “Yes” to the question Has the corporation made an election under subsection 89(11) not to be a CCPC in a prior year and this election has not been revoked? during roll forward if the corporation answered “Yes” to the question Has the corporation made an election under subsection 89(11) not to be a CCPC in the current year? The program retains the answer to the question Has the corporation made an election under subsection 89(11) not to be a CCPC in a prior year and this election has not been revoked? during roll forward.

When the corporation revokes its election under subsection 89(11) not to be a CCPC and indicates that it is a CCPC on line 040 of Form Corporate Identification and Other Information (Jump Code: ID), the program activates the calculations in Schedule 54 (Jump Code: 54) for the low rate income pool instead of the calculations in Schedule 53 (Jump Code: 53) for the general rate income pool. A corporation that revokes its election under subsection 89(11) in the current year is considered not to be a CCPC for the purpose of Schedule 53 and Schedule 54 until the end of the taxation year where it has made the revocation. In addition, if the corporation answers “Yes” to this question, the program indicates “Yes” to the question Has the corporation revoked any previous election made under subsection 89(11) in the previous year? during roll forward.

This question is used by the program to determine if the corporation is considered to be a CCPC for the calculation of the general rate income pool in Schedule 53 (Jump Code: 53) when a revocation under subsection 89(11) has been made.

When it is indicated that the corporation is a deposit insurance corporation, the program performs the following calculations:

- The calculations of Schedule 53, General Rate Income Pool (GRIP) Calculation (Jump Code: 53).

- The calculations of Schedule 55, Part lll.1 Tax on Excessive Eligible Dividend Designations (Jump Code: 55).

Furthermore, when it is indicated that the corporation is a deposit insurance corporation, the program is not calculating the following:

- The general tax reduction, in Schedule 200 (Jump Code: J).

- The low rate income pool, in Schedule 54 (Jump Code: 54).

- The Ontario corporate minimum tax, in Schedule 510 (Jump Code: 510).

The program retains the answer to this question during roll forward. In addition, if the corporation answered “Yes” to the question, the program indicates “Yes” to the question Was the corporation a deposit insurance corporation in the preceding year? during roll forward.

The answer to this question, as well as the answer to the question Is this a deposit insurance corporation as defined in subsection 137.1(5) ITA?, is used by the program to determine if the corporation ceased to be a deposit insurance corporation or if it became a deposit insurance corporation in the taxation year. This information allows the program to answer question 5 in Schedule 53 (Jump Code: 53) and question 2 in schedule 54 (Jump Code: 54).

When the answer to this question is “Yes,” the program assumes that the corporation should be considered as a CCPC for:

- The federal and provincial small business deduction.

- The general tax reduction calculated in Schedule 200 (Jump Code: J).

- The calculation on line 896 of Schedule 200 (Jump Code: J), which relates to the one-month extension of the date the balance of tax is due.

- The calculations in Schedule 7 (Jump Code: 7) with respect to the aggregate investment income and the active business income.

- The manufacturing and processing profits deduction calculated in Schedule 27 (Jump Code: 27).

- The determination of a qualifying corporation on line 101 of Schedule 31 (Jump Code: 31).

- The calculation of the scientific research and experimental development expenditure limit in Schedule 31 and Schedule 49 (Jump Code: 49).

- The Saskatchewan manufacturing and processing profits tax reduction calculated in Schedule 404 (Jump Code: 404).

- The British Columbia scientific research and experimental development tax credit calculated in Schedule 425 (Jump Code: 425).

- The Ontario tax credit for manufacturing and processing calculated in Schedule 502 (Jump Code: 502).

- The calculation on line 100 of Alberta Schedule 12 (Jump Code: A12) which relates to the active business income.

- The calculation of Schedule CO-771.2.1.2 (Jump Code: 771212) with respect to income from an eligible business carried on in Canada by a member of a partnership.

- The determination of the eligibility for the federal quarterly instalments calculated in form Federal Tax Instalments (Jump Code: IFED).

- The determination of the eligibility for the Québec quarterly instalments calculated in form Québec Tax Instalments (Jump Code: IQC).

The program retains the answer to this question during roll forward. Furthermore, if the corporation answered “Yes” to the question and was associated for the business limit, the program indicates “Yes” at the question Was the corporation associated with another corporation for purposes of the allocation of the business limit in the preceding year (subsection 125 ITA)? during roll forward.

When the answer to this question is “Yes,” the program calculates the amount on lines 265 and 275 of Schedule 3 (Jump Code: 3) and the amount of eligible and/or non-eligible dividend refund of Schedule 200 (Jump Code: 200). The program retains the answer to this question during roll forward.

The answer to this question is used to calculate the business limit reduction on line 415 of Schedule 200 (Jump Code: J). When the corporation is not associated with other corporations in the current taxation year and it answers “Yes” to this question, the program calculates the business limit reduction using the amounts in Part 5 of Schedule 33 (Jump Code: 33), Schedule 34 (Jump Code: 34) or Schedule 35 (Jump Code: 35).

When the answer to the question is “Yes,” the program :

- Does not calculate the general tax reduction in Schedule 200 (Jump Code: J).

- Considers that the corporation is a financial institution for the calculation of the taxable capital in Schedule 34 (Jump Code: 34), the calculation of Part VI tax in Schedule 38 (Jump Code: 38) and the calculation of the Saskatchewan financial institutions capital tax in Schedule SJ (Jump Code: SJ).

- Selects box 03 on line 100 of Schedule 524 (Jump Code: 524). When box 03 on line 100 is selected, the program does not calculate the Ontario corporate minimum tax in Schedule 510 (Jump Code: 510).

The program retains the answer to this question during roll forward.

When the answer to this question is “Yes,” the program :

- Does not calculate the general tax reduction in Schedule 200 (Jump Code: J).

- Considers that the corporation is a financial institution for the calculation of the taxable capital in Schedule 34 (Jump Code: 34) and the calculation of Part VI tax in Schedule 38 (Jump Code: 38).

- Calculates the amount on line 160 of Schedule 18 (Jump Code: 18), which relates to the refundable capital gains tax on hand.

- Does not calculate the Ontario corporate minimum tax in Schedule 510 (Jump Code: 510).

- Selects box 1 on line 030 of the Alberta return (Jump Code: AJ).

The program retains the answer to this question during roll forward.

When the answer to this question is “Yes,” the program :

- Does not calculate the general tax reduction and the federal tax abatement in Schedule 200 (Jump Code: J).

- Uses a rate of 25% to calculate line 550 of Schedule 200 (Jump Code: J).

- Does not calculate the British Columbia mining exploration tax credit in Schedule 421 (Jump Code: 421).

- Selects the box Yes at the first question in Part 2 of Schedule 425 (Jump Code: 425) to indicate that the corporation is exempt from tax under section 27 of the Income Tax Act (British Columbia).

- Does not calculate the British Columbia manufacturing and processing tax credit in Schedule 426 (Jump Code: 426).

- Does not calculate the British Columbia training tax credit in Schedule 428 (Jump Code: 428).

- Does not calculate the British Columbia shipbuilding and ship repair tax credit in Schedule 430 (Jump Code: 430).

- Does not calculate the Yukon research and development tax credit in Schedule 442 (Jump Code: 442).

- Does not calculate the Yukon corporation tax for corporations whose taxation year is ending before January 1, 2011, in Schedule 443 (Jump Code: 443).

- Does not calculate the Alberta scientific research and experimental development tax credit in Alberta Schedule 9 (Jump Code: A9)

The program retains the answer to this question during roll forward.

When the answer to this question is “Yes,” the program :

- Considers that the corporation is a financial institution for the purpose of:

- the calculation of the taxable capital in Schedule 34 (Jump Code: 34),

- the calculation of the income tax in Schedule CO-771 (Jump Code: 771),

- the calculation of the business limit in Schedule CO-771.1.3 (Jump Code: 77113),

- the calculation of the paid-up capital in Schedule CO-1140 (Jump Code: 1140) and Schedule CO-1140.A (Jump Code: 1140A), and

- the calculation of the Saskatchewan financial institutions capital tax in Schedule SJ (Jump Code: SJ).

- Selects box 09 on line 100 of Schedule 524 (Jump Code: 524).

- Enters, if required, the minimum amount of $250 of tax on capital payable by the financial institutions of Québec on line 430a of the CO-17 return (Jump Code: QJ).

- Selects box 52 in Schedule CO-771 (Jump Code: 771).

- Does not calculate the $1 million deduction in Schedule CO-1137.A (Jump Code: 1137A).

- Does not complete Schedule CO-1137.E (Jump Code: 1137E).

- Calculates Part 2 and Part 6 in Schedule CO-1159.2 (Jump Code: 11592), which are used to calculate compensation tax.

The program retains the answer to this question during roll forward.

When the answer to this question is “Yes,” the program:

- Considers that the corporation is a financial institution for the purpose of:

- the calculation of the taxable capital in Schedule 34 (Jump Code: 34),

- the calculation of Part VI tax in Schedule 38 (Jump Code: 38),

- the calculation of the income tax in Schedule CO-771 (Jump Code: 771),

- the calculation of the business limit in Schedule CO-771.1.3 (Jump Code: 77113), and

- the calculation of the paid-up capital in Schedule CO-1140 (Jump Code: 1140) and Schedule CO-1140.A (Jump Code: 1140A).

- Selects box 08 on line 100 of Schedule 524 (Jump Code: 524).

- Does not calculate the $1 million deduction in Schedule CO-1137.A (Jump Code: 1137A).

- Does not complete Schedule CO-1137.E (Jump Code: 1137E).

The program retains the answer to this question during roll forward.

When the answer to this question is “Yes,” the program:

- Considers that the corporation is a financial institution for the purpose of:

- the calculation of the taxable capital in Schedule 34 (Jump Code: 34),

- the calculation of Part VI tax in Schedule 38 (Jump Code: 38),

- the calculation of the Newfoundland and Labrador capital tax on financial institutions in Schedule 305 (Jump Code: 305),

- the calculation of the income tax in Schedule CO-771 (Jump Code: 771),

- the calculation of the business limit in Schedule CO-771.1.3 (Jump Code: 77113),

- the calculation of the paid-up capital in Schedule CO-1140 (Jump Code: 1140) and Schedule CO-1140.A (Jump Code: 1140A),

- the calculation of the Manitoba capital tax in Schedule MCT1 (Jump Code: MJ),

- the calculation of the Saskatchewan financial institutions capital tax in Schedule SJ (Jump Code: SJ),

- the calculation of the Prince Edward Island financial institutions capital tax in Schedule PE-Capital tax, Financial Corporation Capital Tax Return (Jump Code: PE-CAP TAX),

- the calculation of the Nova Scotia financial institutions capital tax in Schedule NS-Capital tax, Financial Corporation Capital Tax Return (Jump Code: NS-CAP TAX), and

- the calculation of the New Brunswick financial institutions capital tax in Schedule NB-Capital tax, Financial Corporation Capital Tax Return (Jump Code: NB-CAP TAX).

- Does not calculate the amount on lines 265 and 275 of Schedule 3 (Jump Code: 3).

- Selects box 06 on line 100 of Schedule 524 (Jump Code: 524).

- Enters, if required, the minimum amount of $250 of tax on capital payable by the financial institutions of Québec on line 430a of the CO-17 return (Jump Code: QJ).

- Selects box 52 in Schedule CO-771 (Jump Code: 771).

- Does not calculate the $1 million deduction in Schedule CO-1137.A (Jump Code: 1137A).

- Does not complete Schedule CO-1137.E (Jump Code: 1137E).

- Calculates Part 5.4, which relates to the deduction for the operation of an IFC granted to a bank in Schedules CO-1140 and CO-1140.A.

- Calculates Part 2 and Part 6 in Schedule CO-1159.2 (Jump Code: 11592), which are used to calculate compensation tax.

The program retains the answer to this question during roll forward.

When the answer to this question is “Yes,” the program:

- Considers that the corporation is a financial institution for the purpose of:

- the calculation of the taxable capital in Schedule 34 (Jump Code: 34),

- the calculation of Part VI tax in Schedule 38 (Jump Code: 38),

- the calculation of the Newfoundland and Labrador capital tax on financial institutions in Schedule 305 (Jump Code: 305),

- the calculation of the income tax in Schedule CO-771 (Jump Code: 771),

- the calculation of the business limit in Schedule CO-771.1.3 (Jump Code: 77113),

- the calculation of the paid-up capital in Schedule CO-1140 (Jump Code: 1140) and Schedule CO-1140.A (Jump Code: 1140A),

- the calculation of the Manitoba capital tax in Schedule MCT1 (Jump Code: MJ),

- the calculation of the Saskatchewan financial institutions capital tax in Schedule SJ (Jump Code: SJ),

- the Prince Edward Island financial institutions capital tax in Schedule PE-Capital tax, Financial Corporation Capital Tax Return (Jump Code: PE-CAP TAX),

- the Nova Scotia financial institutions capital tax in Schedule NS-Capital tax, Financial Corporation Capital Tax Return (Jump Code: NS-CAP TAX), and

- the New Brunswick financial institutions capital tax in Schedule NB-Capital tax, Financial Corporation Capital Tax Return (Jump Code: NB-CAP TAX).

- Enters, if required, the minimum amount of $250 of tax on capital payable by the financial institutions of Québec on line 430a of the CO-17 return (Jump Code: QJ).

- Selects box 52 in Schedule CO-771 (Jump Code: 771).

- Does not calculate the $1 million deduction in Schedule CO-1137.A (Jump Code: 1137A).

- Does not complete Schedule CO-1137.E (Jump Code: 1137E).

- Calculates Part 2 and Part 6 of Schedule CO-1159.2 (Jump Code: 11592), which are used to calculate compensation tax.

The program retains the answer to this question during roll forward.

When the answer to this question is “Yes,” the program:

- Calculates the registration fee for cooperatives on line 441b of Schedule CO-17 (Jump Code: QJ) and Schedule CO-17.SP (Jump Code: QJSP).

- Indicates, in the CO-17 return, that the corporation is a cooperative exempt from capital tax. When the corporation is a cooperative exempt from capital tax, the program:

- Does not calculate the capital tax on line 430a of the CO-17 return.

- Calculates the paid-up capital in Schedule CO-1136.CS (Jump Code: 1136CS) instead of Schedule CO-1136 (Jump Code: 1136).

- Does not calculate the $1 million deduction in Schedule CO-1137.A (Jump Code: 1137A).

- Does not complete Schedule CO-1137.E (Jump Code: 1137E).

- Uses the paid-up capital from Schedule CO-1136 to calculate line 54 in Schedule CO-771 (Jump Code: 771).

- Does not calculate the $1 million deduction in Schedule CO-1137.A (Jump Code: 1137A).

- Selects box 3 on line 030 of the Alberta return (Jump Code: AJ).

- Does not calculate the Manitoba capital tax in Schedule MCT1 (Jump Code: MJ).

- Does not calculate the Saskatchewan capital tax in Schedule SCT1 (Jump Code: SJ).

The program retains the answer to this question during roll forward.

When the answer to this question is “Yes,” the program assumes that the corporation should be considered as a CCPC for:

- The federal and provincial small business deduction.

- The general tax reduction calculated in Schedule 200 (Jump Code: J). Note that the aggregate investment income is not subtracted when the answer to this question is “Yes.”

- The aggregate investment income on line 440 of Schedule 200.

- The calculations in Schedule 7 (Jump Code: 7) for the active business income.

- The manufacturing and processing profits deduction calculated in Schedule 27 (Jump Code: 27).

- The determination of a qualifying corporation on line 101 of Schedule 31 (Jump Code: 31).

- The calculation of the scientific research and experimental development expenditure limit in Schedule 31 and Schedule 49 (Jump Code: 49).

- The calculation of the general rate income pool in Schedule 53 (Jump Code: 53).

- The calculation of Part lll.1 tax on excessive eligible dividend designations in Schedule 55 (Jump Code: 55).

- The calculation of the Saskatchewan manufacturing and processing profits tax reduction in Schedule 404 (Jump Code: 404).

- The calculation of the British Columbia scientific research and experimental development tax credit in Schedule 425 (Jump Code: 425).

- The calculation of the Ontario tax credit for manufacturing and processing in Schedule 502 (Jump Code: 502).

- The calculation of line 100 in Alberta Schedule 12 (Jump Code: A12), that relates to the active business income.

- The calculation of Schedule CO-771.2.1.2 (Jump Code: 771212) with respect to income from an eligible business carried on in Canada by a member of a partnership.

- The determination of the eligibility for the federal quarterly instalments calculated in Form Federal Tax Instalments (Jump Code: IFED).

- The determination of the eligibility for the Québec quarterly instalments calculated in Form Québec Tax Instalments (Jump Code: IQC).

The program retains the answer to this question during roll forward. Furthermore, if the corporation answered “Yes” to the question and was associated for the business limit, the program indicates “Yes” at the question Was the corporation associated with another corporation for purposes of the allocation of the business limit in the preceding year (subsection 125 ITA)? during roll forward. The program also indicates “Yes” at the question Was the corporation a cooperative that is a CCPC for the purpose of the general tax reduction and the small business deduction (136(1) ITA) in the preceding year? during roll forward if the corporation answered “Yes” to the question.

The answer to this question, as well as the answer to the question If yes, is it a cooperative corporation that is a CCPC for the purpose of the general tax reduction and the small business deduction (136(1) ITA)?, is used by the program to determine if the corporation becomes a CCPC or ceases to be a CCPC for the calculations in Schedule 53 (Jump Code: 53) relating to the general rate income pool and the calculations in Schedule 54 (Jump Code: 54) relating to the low rate income pool.

When the answer to this question is “Yes,” the program:

- Does not calculate the general tax reduction in Schedule 200 (Jump Code: J).

- Calculates the amount on line 160 of Schedule 18 (Jump Code: 18), which relates to the refundable capital gains tax on hand.

- Selects box 14 on line 100 of Schedule 524 (Jump Code: 524). When box 14 on line 100 is selected, the program does not calculate the Ontario corporate minimum tax in Schedule 510 (Jump Code: 510).

- Selects box 2 on line 030 of the Alberta return (Jump Code: AJ).

The program retains the answer to this question during roll forward.

When the answer to this question is “Yes,” the program:

- Considers that the corporation is an insurance corporation for the calculation of the taxable capital in Schedule 35 (Jump Code: 35), the calculation of the business limit in Schedule CO-771.1.3 (Jump Code: 77113) and the calculation of the paid-up capital in Schedule CO-1140.A (Jump Code: 1140A).

- Indicates, in Form RSI, Electronic Filing and Bar Codes Control Workchart (Jump Code: RSI-EFILE-BAR CODES), that the corporation cannot file, and is not required to file, its return electronically with the Québec government.

- Uses the taxable capital in Schedule 35 for the calculation of line 415 in Schedule 200 (Jump Code: J), which relates to the business limit reduction.

- Does not print the GIFI schedules when they are not completed.

- Does not calculate the amount on lines 2365 and 275 of Schedule 3 (Jump Code: 3).

- Enters, when rolling forward, the amount of taxable capital calculated in Schedule 35 in the field “Specified capital amount for the previous tax year” of Section “Schedule 566 – Ontario innovation tax credit” of Form Related and Associated Corporations Workchart (Jump Code : 9 WORKCHART) of the filing corporation.

- Selects box 11 on line 100 of Schedule 524 (Jump Code: 524).

- Does not calculate the capital tax on line 430a of Schedule CO-17 (Jump Code: QJ).

- Selects box 51 in Schedule CO-771 (Jump Code: 771).

- Does not calculate the $1 million deduction in Schedule CO-1137.A (Jump Code: 1137A).

- Does not complete Schedule CO-1137.E (Jump Code: 1137E).

- Calculates Part 3 and Part 6 of Schedule CO-1159.2 (Jump Code: 11592), which are used to calculate compensation tax.

- Does not calculate the Saskatchewan capital tax in Schedule SCT1 (Jump Code: SJ).

The program retains the answer to this question during roll forward.

When the answer to this question is “Yes,” the program considers the corporation as a life insurance corporation for the purpose of:

- the calculation of Part VI tax in Schedule 38 (Jump Code: 38),

- the calculation of the Ontario corporate minimum tax in Schedule 510 (Jump Code: 510), and

- the calculation of the tax on capital of life insurance corporations in Schedule CO-1175.4 (Jump Code: 11754).

The program retains the answer to this question during roll forward.

When the answer to this question is “Yes,” the program:

- Considers the corporation as a CCPC for the purpose of:

- the calculation of the federal and provincial small business deduction,

- the calculation of the general tax reduction in Schedule 200 (Jump Code: J),

- the calculations in Schedule 7 (Jump Code: 7) for the aggregate investment income and the active business income,

- the determination of a qualifying corporation on line 101 of Schedule 31 (Jump Code: 31),

- the calculation of the scientific research and experimental development expenditure limit in Schedule 31 and Schedule 49 (Jump Code: 49),

- the calculation of the British Columbia scientific research and experimental development tax credit in Schedule 425 (Jump Code: 425),

- the calculations in Schedule CO-771.2.1.2 (Jump Code: 771212) with respect to income from an eligible business carried on in Canada by a member of a partnership,

- the calculation on line 100 of Alberta Schedule 12 (Jump Code: A12), which relates to the active business income,

- the determination of the eligibility for the federal quarterly instalments calculated in Form Federal Tax Instalments (Jump Code: IFED), and

- the determination of the eligibility for the Québec quarterly instalments calculated in Form Québec Tax Instalments (Jump Code: IQC).

- Considers that the corporation is a financial institution for the purpose of:

- the calculation of the taxable capital in Schedule 34 (Jump Code: 34),

- the calculation of the income tax in Schedule CO-771 (Jump Code: 771),

- the calculation of the business limit in Schedule CO-771.1.3 (Jump Code: 77113),

- the calculation of the paid-up capital in Schedule CO-1140 (Jump Code: 1140) and Schedule CO-1140.A (Jump Code: 1140A).

- Considers the corporation as a credit union for the purpose of:

- the charitable donations deduction calculations in Schedule 2 (Jump Code: 2),

- the Manitoba tax calculations in Schedule 383 (Jump Code: 383),

- the Saskatchewan tax calculations in Schedule 411 (Jump Code: 411),

- the British Columbia tax calculations in Schedule 427 (Jump Code: 427),

- the credit union tax reduction calculations in Part 6 of Schedule 500 (Jump Code: 500),

- the calculation of the income tax in Schedule CO-771 (Jump Code: 771),

- the calculation of the paid-up capital in Schedule CO-1140 (Jump Code: 1140) and Schedule CO-1140.A (Jump Code: 1140A),

- the Alberta charitable donations deduction calculations in Alberta Schedule 20 (Jump Code: A20),

- the calculation of the net income reconciliation in Schedule 1-C (Jump Code: 1CU),

- the calculations of the credit union deductions in Schedule 17 (Jump Code: 17),

- the calculation of the tax of the credit unions and caisses populaires profits tax return (Jump Code: MB-CREDIT UNIONS),

- the calculation of the federal EDI Instalment Workchart (Jump Code: IF EDI) and the calculation of the Québec EDI Instalment Workchart (Jump Code: IQ EDI).

- Enters, when rolling forward, the amount of taxable capital calculated at line 690 of Schedule 34 in the field “Specified capital amount for the previous tax year” of Section “Schedule 566 – Ontario innovation tax credit” of Form Related and Associated Corporations Workchart (Jump Code : 9 WORKCHART) of the filing corporation.

- Selects box 04 on line 100 of Schedule 524 (Jump Code: 524).

- Enters, if required, the minimum amount of $250 of tax on capital payable by the financial institutions of Québec on line 430a of the CO-17 return (Jump Code: QJ).

- Does not calculate the $1 million deduction in Schedule CO-1137.A (Jump Code: 1137A).

- Does not complete Schedule CO-1137.E (Jump Code: 1137E).

- Calculates Part 2 and Part 6 in Schedule CO-1159.2 (Jump Code: 11592), which are used for the calculation of compensation tax.

- Selects box 4 on line 030 of the Alberta return (Jump Code: AJ).

- Does not calculate the Manitoba capital tax in Schedule MCT1 (Jump Code: MJ).

- Does not calculate the Saskatchewan capital tax in Schedule SCT1 (Jump Code: SJ).

- Selects the box Select this box if you want the instalments to be calculated without taking the applicable threshold into account in Form Federal Tax Instalments (Jump Code: IFED) and in Form Québec Tax Instalment (Jump Code: IQC).

The program retains the answer to this question during roll forward. Furthermore, if the corporation answered “Yes” to the question and was associated for the business limit, the program indicates “Yes” at the question Was the corporation associated with another corporation for purposes of the allocation of the business limit in the preceding year (subsection 125 ITA)? during roll forward.

When the answer to this question is “Yes” and the corporation indicates that it is a credit union, the program calculates the general tax reduction amount in the “General tax reduction for Canadian-controlled private corporations” section of Schedule 200 (Jump Code: J) by taking the aggregate investment income into account. Note that in such a case, the aggregate investment income is calculated on line 440 of Schedule 200.

When the answer to this question is “Yes” and the corporation indicates that it is a credit union, the program calculates Part VI tax on line 720 of Schedule 200, T2 – Corporation Income Tax Return (Jump Code: J).

The program retains the answer to this question during roll forward.

When the answer to this question is “Yes,” the program:

- Considers the corporation as an oil refining corporation for the calculation of the income tax in Schedule CO-771 (Jump Code: 771).

- Does not calculate the Québec tax credit for investment in Schedule CO-1029.8.36.IN (Jump Code: 1029836IN).

The program retains the answer to this question during roll forward.

When the answer to this question is “Yes,” the program:

- Indicates “No” at the question Is the corporation incorporated in Ontario under the Business Corporations Act or the Corporations Act? in Schedule 546 (Jump Code: 546).

- Indicates “Yes,” if all the conditions are applicable, at the question Is the CO-17.SP return applicable? in Schedule CO-17 (Jump Code: QJ).

The program retains the answer to this question during roll forward.

This question is used solely to indicate information that can be useful to identify the type of return. The program does not perform any calculation based on the answer provided. The answer to this question is retained during roll forward.

Through the CRA’s Voluntary Disclosures Program (VDP), a corporation can make an application to correct inaccurate or incomplete information, or to disclose information not previously reported to regularize its fiscal situation with the CRA. A corporation wanting to make such an application must complete Form RC199, Voluntary Disclosures Program (VDP) Application and send it to the CRA. For more information on the VDP, consult the CRA Web page Voluntary Disclosures Program – Introduction and the Information Circular IC00-1R6 - Voluntary Disclosures Program.

If the answer to the question is “Yes,” the program will answer “No” to the question Must this return be electronically filed with the CRA in pursuance of subsection 150.1(2.1) ITA? in Form RSI, Electronic Filing and Bar Codes Control Workchart (Jump Code: RSI-EFILE-BAR CODES), as it is not mandatory to file the return electronically in this situation.

Through the Alberta’s Tax and Revenue Administration (ATRA) Voluntary Disclosures Program, a corporation can make an application to correct inaccurate or incomplete information, or disclose information not previously reported to regularize its fiscal situation. A corporation wanting to make a voluntary disclosure must notify the ATRA in writing at the time of filing its corporate tax return (or before). A covering letter explaining the voluntary disclosure should accompany the tax return being filed. For more information on the program, consult the Alberta Information Circular CT-11R3: Voluntary Disclosures.

If the answer to this question is “Yes,” the program will answer “No” to the question Is this return eligible for Corporation Internet Filing (AT1 Net File)? in Form RSI, Electronic Filing and Bar Codes Control Workchart (Jump Code: RSI-EFILE-BAR CODES), as it is not possible to transmit the return electronically in this situation.

The Revenu Québec Voluntary Disclosure Program provides corporations with the opportunity to regularize their fiscal situation with Revenu Québec in order to comply with Québec fiscal law. A corporation that wants to make a voluntary disclosure must complete Form LM-15-V, Voluntary Disclosure and send it to Revenu Québec. For more information on the program, consult the Revenu Québec Web page Voluntary disclosure and the guide IN-309, Voluntary Disclosure: rectifying your tax situation.

If the answer to this question is “Yes,” the program will answer “No” to the question Is this return eligible for Corporation Internet Filing (CO-17 EFILE)? in Form RSI, Electronic Filing and Bar Codes Control Workchart (Jump Code: RSI-EFILE-BAR CODES), as it is not possible to transmit the return electronically in this situation.

Additional information

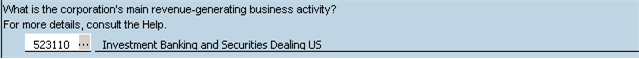

An NAICS code is required for all corporations, except for an inactive corporation (T2 line 280 = Yes). According to the CRA requirements, such code is mandatory when the tax return is filed using tax software.

Important

If the NAICS code is missing, it will not be possible to EFILE the return or to print it in bar code format.

NAICS codes: (North American Industry Classification System)

NAICS codes definition

North American Industry Classification System (NAICS) codes are hierarchical numerical codes used by the member countries of the North American Free Trade Agreement to provide common definitions and descriptions of our industries and business activities. The government of Canada as well as the governments of the provinces and territories use the data provided by NAICS codes for economic analysis and fiscal policy responses.

You must indicate the corporation’s main business activity by selecting the applicable North American Industry Classification System (NAICS) code. For more details on business activities related to an NAICS code in the search box list, you can consult the list of definitions on the Internet at the following address: http://www23.statcan.gc.ca/imdb/p3VD.pl?Function=getVD&TVD=1181553

Tip: To facilitate the selection of the appropriate code, you can display a search box by clicking the ellipsis points of the data entry field or by using Alt+Down arrow shortcut.

It is crucial that the most accurate business activity is selected the first time since the first year’s code is carried forward to subsequent years. Therefore, for subsequent years, the corporation will be asked to validate that the business description chosen for the last return filed is still accurate.

Explanation with respect to superscript symbols (CAN, MEX, US) at the end of NAICS class titles

These symbols are for your reference. Only the NAICS code is transmitted to the CRA; the descriptions are not transmitted.

The symbols below are used to signify comparability of similar business activities performed in Canada (Statistique Canada), the United States (Economic Classification Policy Committee (ECPC)) and Mexico (Instituto Nacional de Estadística, Geografía e Informática (INEGI)).

|

CAN |

Canadian industry only |

|

MEX |

Canadian and Mexican industries are comparable |

|

US |

Canadian and United States industries are comparable |

|

[Blank] |

[No symbol] Canadian, Mexican and United States Industries are comparable. |

If you have any questions on selecting the appropriate NAICS code to describe the active corporation’s main revenue-generating business activity, please call the Business Enquiries line at 1-800-959-5525.

Instalment paid

Amount used to determine the answer to the question on line 896 of the T2 return

The “General information” section of Schedule 9 WORKCHART, Related and Associated Corporations Workchart (Jump Code: 9 WORKCHART)

Lines Taxable income of prior taxation year and Reduced business limit of prior taxation year

Enter the corporation’s taxable income for the prior taxation year. If the corporation has more than one taxation year ending in the same current or previous taxation year, enter the taxable income for the taxation year ending in the calendar year preceding the taxation year covered.

Enter the corporation's reduced business limit for the previous taxation year. If the corporation has more than one taxation year ending in the current or previous taxation year, enter the total of the reduced business limit for the taxation year ending in the calendar year preceding the taxation year covered.

This data is required to allow the program to correctly answer the question on line 896, If the corporation is a Canadian-controlled private corporation throughout the tax year, does it qualify for the one-month extension of the date that balance of tax is due?, of the T2 tax return.

One of the rules relating to the extension of the 2-month statutory time limit to pay the balance due stipulates that the corporation’s total taxable income must be equal to or less than its reduced business limit for the previous taxation year and that, where the corporation is associated with other corporations, the total taxable income of the corporations in the group must be equal to or less than the total of the reduced business limits for the previous year of those same corporations.

When the corporation is associated with other corporations, to determine whether the time limit can be extended or not, the program first adds the taxable income for the preceding taxation year of all associated corporations listed in Schedule 23. Then, the program adds all reduced business limits for the preceding taxation year of all these corporations. When the total taxable income does not exceed the total business limits, the eligible CCPC will qualify for the three-month delay based on this rule.

To qualify for the extension of the 2-month statutory time limit to pay the balance due, the corporation must also meet the two following criteria:

It must have been a CCPC throughout the year.

An amount must have been deducted under section 125 of the ITA in computing the corporation’s tax payable for the current or previous taxation year.

Certification

Line 956 – Telephone number of the authorized signing officer

If the telephone number is not from Canada or the USA, enter it as per the following examples that were provided to us by the CRA:

Example 1:

Sydney, Australia

Telephone number = 123456

City code = 2

Country code = 61

Enter the telephone number in the field of line 956 as follows: 6121234560

Note that a dummy zero is used as the tenth digit.

Example 2:

Cambridge, G.B.

Telephone number = 123 4567

City code = 1223

Country code = 44

Enter the telephone number in the field of line 956 as follows: 2231234567

Note that the ten digits of the complete digital sequence are used.

Canada Revenue Agency’s (CRA) E-mail Notification for My Business Account

This section allows you to submit an e-mail address to receive e-mail notification for the corporation’s account on the CRA’s My Business Account portal. Corporations that submit their e-mail address must register for and then sign in to the My Business Account portal in order to access and manage the documents related to e-mail notifications.

Note that the registration for the e-mail notification is only possible through initial returns that are electronically transmitted to the CRA; therefore, an amended return cannot be used to register for this service.

If the corporation registers for this service, the CRA will send an e-mail notification to the corporation when changes to their account have been made, or when eligible notices, letters, or statements are available for viewing in their My Business Account portal. All CRA mail available in My Business Account will be presumed to have been received on the date that the email notification is sent. Any mail that is eligible for electronic delivery will no longer be printed and mailed to the corporation.

For more information, please consult the following CRA Web pages: Terms of use for email notifications and Access to information and privacy at the Canada Revenue Agency.

Filing information

Was the return prepared by a tax preparer for a fee? (T2 line 920)

This question is used to determine whether or not the EFILE number must be entered on line 920 of Schedule 200. The program indicates an EFILE number only when all the following conditions are complied with:

- the answer to this question is “Yes”;

- the corporation’s taxation year is ending in 2012 or after; and

- the date of signature on line 955 of Schedule 200 is in 2013 or after.

The EFILE number entered by the program will be:

- the electronic filer number indicated in Form T183, when this form has been modified using an override (whether or not the form is applicable); or

- the EFILE number indicated in the options and settings under Electronic Services/Identification/Federal.

For more information, consult the CRA Web page, Mandatory electronic filing for tax preparers.

See Also

Section 261 – Election to report in a functional currency