|

Notice: The information on this page is only for users of Personal Taxprep 2018. If you are using Personal Taxprep Classic 2018, consult the Professional Centre in your program or our Web site. To regularly receive information on the latest version of Personal Taxprep, make sure that you are subscribed to the enhanced edition of Taxprep e-Bulletin service. Consult the News and Product Support page of our Web site to check your Taxprep e-Bulletin service subscription. |

Troubleshooting

To assist you in identifying clients that could be affected by the described problems, a downloadable client filter and customized diagnostic template is associated with most troubleshooting memos. These templates allow you to display a diagnostic in the returns that have tax situations that were the subject of a Troubleshooting Memo and provide access to a list of clients affected by the problems described.

Installing the client filter and diagnostic template

To find the predefined folder for customized client filters or diagnostics. proceed as follows:

- Launch Personal Taxprep.

- On the Tools menu, click Options and Settings.

- Under Options, click File Locations.

-

Verify the predefined location for the filters and diagnostics. After the installation, the default location is usually the following: My Documents\Wolters Kluwer\T1 Taxprep 2018\Filter and Diagnostics\.

- Copy the downloaded file to this location.

The client filter will be available in the Client Manager, while the diagnostic will display in the relevant returns.

Note: If you must download a client filter and diagnostic template, you can do so from the link in the section of a problem. To download all templates in a single operation, click the Download all templates button, then copy all zipped files into the folder My Documents\Wolters Kluwer\T1 Taxprep 2018\Filter and Diagnostics\.

Federal

T12018-001 (Week of December 16, 2018) - Rolling forward child care expenses for a 16-year old child on December 31, 2017, or a child deceased in 2017

T12018-001 (Week of December 16, 2018) - Rolling forward child care expenses for a 16-year old child on December 31, 2017, or a child deceased in 2017

|

Affected Version |

Corrected Version |

Template |

|

Version 2018 1.0 |

Version 2018 2.0 |

problem

When rolling forward the following two types of Taxprep 2017 client files, the program stops working and the affected client files are not rolled forward:

- Client file containing child care expenses for a child born in 2001 and who is not disabled

- Client file containing child care expenses for a child deceased in 2017

solution

Client file containing child care expenses for a child born in 2001 and who is not disabled:

- Bring forward the child’s date of birth by one year (year of birth: 2002 instead of 2001) in the Taxprep 2017 client file. Save the client file and roll it forward.

- After the roll forward, in the Taxprep 2018 client file and in the Taxprep 2017 client file, re-enter the correct year of birth for the child in the FAM form.

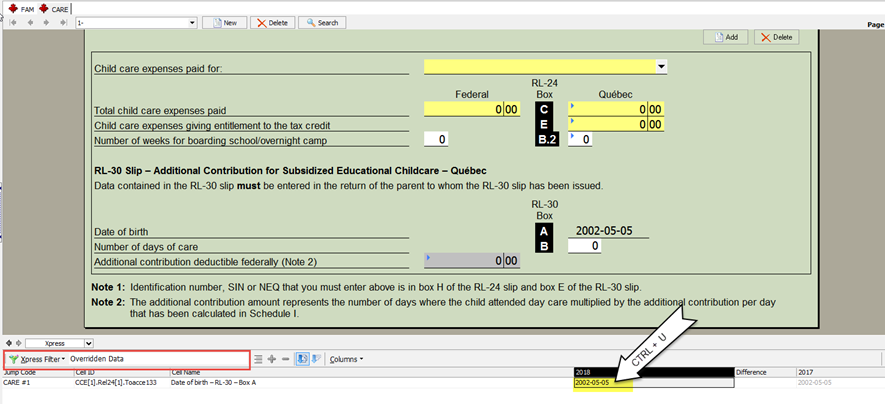

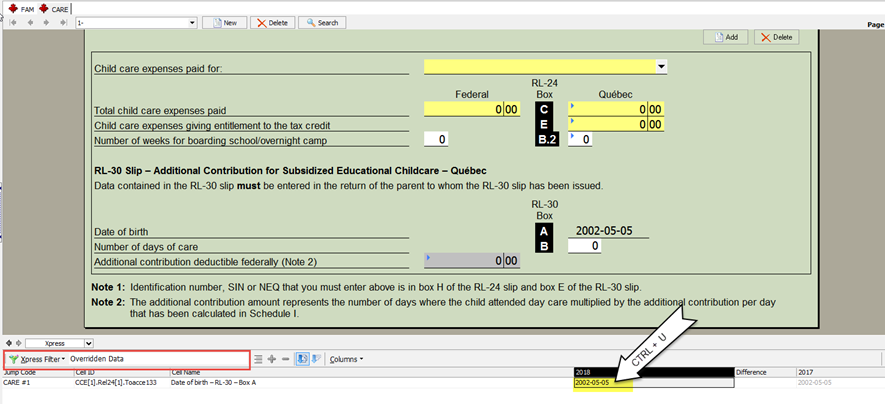

- For clients using the TP1 version: In the 2018 client file, display the Xpress tool (filter: Overridden data) and delete the override in the field for box A of the RL 30 slip by pressing Ctrl + U. The override is in the taxpayer’s or the spouse’s return in which the child care expenses have been entered in 2017.

Client file containing child care expenses for a child deceased in 2017:

- Delete the child’s date of death in the Taxprep 2017 client file. Save the client file and roll it forward.

- After the roll forward, in the Taxprep 2018 client file, delete the FAM form of the child deceased in 2017 and, in the Taxprep 2017 client file, re-enter the child’s date of death in the FAM form.

- For clients using the TP1 version: In the 2018 client file, display the Xpress tool (filter: Overridden data) and delete the override in the field for box A of the RL 30 slip by pressing Ctrl + U. The override is in the taxpayer’s or the spouse’s return in which the child care expenses have been entered in 2017.

Other solution for the two types of client files:

Wait for version 2.0 of Personal Taxprep 2018.

If you want to roll forward your other client files with version 1.0 of Personal Taxprep 2018 but want to wait for version 2.0 to roll forward the client files affected by the roll forward problem, you can temporarily move these client files to another folder. You can then select all other client files and roll them forward in batch without the program stopping. Once version 2.0 is installed, you will only have to roll forward the client files affected by the problem. This can be particularly useful if many of your client files are affected by the problem.

This problem will be corrected in version 2.0 of Personal Taxprep 2018, which is scheduled to be released mid-February 2019.